27.11.2020

Raging a psychological warfare via UMA

The age-old adage that there is no smoke without fire brings to mind the relevance of the unusual market activity (UMA) queries that are often raised by Bursa Malaysia Securities Bhd on listing issuers whose stock prices that have scaled to dizzying heights without well-grounded reasons.

Although it does not necessitate stock trading suspension, UMA is itself a signal that the market regulator has put the stock under its watchful eye, hence most investors (or speculators) tend to stay away from that particular stock.

Even when the company in question chooses to furnish the standard line of “the Board is not aware of the cause of the unusual price and/or trading activity”, Bursa Malaysia will continue to monitor indefinitely its trading activity and corporate developments.

“Where the reply to the UMA query is found to be inaccurate or misleading subsequently, enforcement action may be taken against the listed issuer and the culpable directors for breach of the Main/ACE Market/LEAP Market Listing Requirements,” added the market regulator.

But in the event that the UMA query alone is unable to do the trick, Bursa Malaysia will not hesitate to issue a ‘trading advice’ to investors to exercise caution in their trading.

Such action was imposed recently on GETS Global Bhd whose share price has continued to rise sharply despite being slapped with two UMA queries on 20 October and 12 November respectively.

On both occasions, the company has in its responses confirmed that it was unaware of any corporate development or explanation that could give rise to the unusual trading activities in its shares.

“Bursa Malaysia Securities would like to advise investors to exercise caution and to make informed decisions in trading of GETS shares,” read the trading advice dated 16 November. “Bursa Malaysia Securities will not hesitate to take appropriate regulatory action to ensure fair and orderly trading of GETS shares.”

On the following trading day, the loss-making bus operator saw it shares nosedive by as much as RM1.19 or 29.97% to RM2.78 before paring losses to close at RM3.11.

A day earlier, the company saw its share price skyrocket by 80 sen or 25.24% to close at RM3.97 after touching an all-time high of RM4.05. It closed at RM2.96 on 25 November.

To re-cap, GETS which hit an all-time low of 3.5 sen on 19 March commenced a steep uptrend on 26 August when it jumped 30 sen or 70.3% to 53.5 sen.

This was when the company was slapped with its first UMA to which it attributed the surge in its share price to the emergence of a new substantial shareholder in Teong Lian Aik who holds 31.87% equity interest in the company.

In contrast to the skyrocketing share price, ironically GETS’ financial performance is heading south with widening net loss of RM20 million in financial year ended 30 June 2020 as compared to RM9.7 million the year before. Revenue was lower at RM21.9 million, against RM32.9 million in FY19.

In general, whenever a company furnishes the standard response of “the Board is not aware of the cause of the unusual price and/or trading activity”, minority shareholders need to use common sense to weigh whether there is a basis to believe that the company’s board/management is unaware of the reason/s behind the sudden surge in its stock price and volume. Again, as stated earlier, there is no smoke without a fire.

Often enough, if the daily trading volumes accounted for a big percentage of the outstanding shares of a listed company, the major shareholders are most likely to be aware of the reasons driving the heavy trading volumes.

Likewise, the company’s key management, too, should be fully aware of what its major shareholders are up to.

- Beware of the low public spread conundrum

After being in hiatus for over five years due to low public shareholding spread, shares of Hong Leong Capital Bhd (HLCap) resumed trading on 13 November, only for its loyal investors to be treated to a rude shock. Part of the reasons for this rude shock is the current dire market conditions and the COVID-19 pandemic.

The share price which re-opened at RM9.15 tumbled to the limit down level of RM6.41 at one stage before closing at RM7.10, down RM2.05 or 22.4%.

The trading of HLCap shares was suspended with effect from 26 March 2015 as the company’s appeal for not meeting the public shareholding spread requirement of 25% was rejected by Bursa Malaysia.

Inability to meet the public shareholding spread requirement has been a perennial problem for HLCap since 2012. As of 31 December 2014, the company's public spread stood at 18.67%.

The resumption of trading was made possible after HLCap’s majority shareholder, Hong Leong Financial Group Bhd (HLFG), completed a private placement of 27 million existing ordinary shares in HLCap on 9 November to increase the company’s public shareholding spread.

Following the completion of the said private placement, HLCap’s public shareholding spread was raised to 29.60%, thus meeting the requirements set out in Paragraph 8.02(1) of the Listing Requirements.

Following the disposal of the shares, HLFG's stake in HLCap is reduced to 173.8 million shares or 70.396%.

HLCap was last traded at RM9.38 prior to its five-year suspension, thus giving it a market capitalisation of RM2.26 billion. In early November, the company had paid out a dividend of 23 sen per share.

As the HLCap experience has shown, minority shareholders must never disregard the public shareholding spread requirement as such disregard may lead to an indefinite suspension period (of their stocks).

Interestingly, Bursa Malaysia has issued a consultation paper on 23 July to seek public feedback on its proposed amendments to the Main Market and ACE Market Listing Requirements (LR) with regard to a lower public holding spread premised on companies’ market capitalisation.

This will pave the way for a review if a lower public spread – notably one that ranges between 15% and 25% – can be accepted for some large-listed issuers provided that such lower percentage is sufficient for a liquid market.

Based on the market regulator’s proposed objective criteria that is premised on market cap threshold, companies must have at least RM1 billion but less than RM3 billion market cap to be considered for a minimum acceptable lower public spread of 20%.

Bursa Malaysia may accept a minimum acceptable lower public spread of 15% for companies with a market cap of RM3 billion and more.

Additionally, the exchange said it will take into consideration other subjective criteria such as sufficiency of liquidity, the orderliness of trading of the securities, corporate governance conduct and compliance records of the listed issuer/applicant and its directors, as well as the justification necessitating the lower public spread.

Devanesan Evanson

Chief Executive Officer

MSWG AGM/EGM Weekly Watch 30 November – 4 December 2020

For this week, the following are the AGMs/EGMs of companies which are in the Minority Shareholders Watch Group’s (MSWG) watch list.

The summary of points of interest is highlighted here, while the details of the questions to the companies can be obtained via MSWG’s website at www.mswg.org.my.

|

Date & Time |

Company |

Quick-take |

|

30.11.20 (Mon) |

Bonia Corporation Bhd (AGM) |

The retail landscape is evolving rapidly and Bonia has to relook at its business model as e-commerce is grow faster than the traditional brick and mortar outlets. As incomes have been severely affected due to the pandemic, consumers are becoming more discerning with their spending and this could affect the demand for branded products. |

|

30.11.20 (Mon) |

Priceworth International Bhd (AGM) |

The Company had narrowed its net loss to RM67.2 million for FY20 as compared to a net loss of RM155.7 million in FY19. It has plans to venture into the production of quality engineering wood products for FYE 2021 and this may be a catalyst to boost its earnings. |

|

30.11.20 (Mon) |

Permaju Industries Bhd (AGM) |

Revenue declined from RM114.4 million in FPE 2019 (18-months) to RM57.6 million in FYE 2020 mainly due to lower revenue from the automotive segment. It continued to be in red with a net loss of RM7.4 million (FPE2019: net loss of RM8.9 million). Recently, it has acquired 16.97% and 12.43% stakes in Meridian Berhad and PNE PCB Berhad respectively for RM26 million and RM27 million. With the weak performance of Permaju’s businesses and the on-going Covid-19 pandemic, will the acquisitions help Permaju to uplift its performance? |

|

30.11.20 (Mon) |

Permaju Industries Bhd (EGM) |

The Company has proposed establishment of an ESOS scheme for its eligible directors and employees. |

|

30.11.20 (Mon) |

TA Enterprise Bhd (EGM) |

TAE will seek shareholders’ approval on two resolutions namely, the proposed acquisition of additional interest in TA Global Berhad (TAG) via a Proposed Conditional Voluntary Take-over Offer (VGO) for 28 sen a share, and proposed issuance of up to 555.5 million new TAE shares at an issue price of 65.5 sen each to be subscribed by Datuk Tony Tiah Thee Kian to fund the cash option pursuant to the Proposed VGO. |

|

01.12.20 (Tue) |

YTL Power International Bhd |

FY2020 has been a challenging year for YTL Power. Its net profit attributable to shareholders fell to all-time low of RM67.64 million in FY20, mainly due to substantial segmental loss of RM264.77 million recorded by its telecommunications business. Nevertheless, the recent acquisition of Tuaspring Pte Ltd power plant and assets might help to redress the overcapacity issue in Singapore and subsequently help to improve performance of the multi-utilities business. |

|

01.12.20 (Tue) |

YTL Power International Bhd |

The EGM is to seek shareholders’ approval for the establishment of a new ESOS and issuance of share options to directors including independent non-executive directors (INEDs). In line with better CG, MSWG does not encourage the practice of giving option to INEDs as they play the governance role in the Company, and are responsible for monitoring the option allocation to employees and executive directors. |

|

01.12.20 (Tue) |

YTL Corporation Bhd (AGM) |

The Companies businesses have been severely affected by the pandemic and moving forward its performance would very much depend on the strategies that it puts in place to ensure its profitability during tough economic times. Its Cement segment and Hotel businesses had posted weak results in FYE 2020 and its Hotel business is expected to continue to perform poorly due to movement control measures imposed by countries globally. |

|

02.12.20 (Wed) |

Redtone International Bhd |

Redtone recorded a revenue of RM177.9 million (FPE 2019: RM211.4 million) and pre-tax profit of RM19.7 million in FY20 (FPE 2019: RM33.6 million). The lower profit was due to the impairment loss on intangible asset amounting to RM24.7 million. Some of the key concerns are namely, the high reliance on inter-segment revenue for Managed Telecommunications Network Services and credit concentration risk where two customers represented approximately 83% (2019: 63%) of the total trade receivables. |

|

02.12.20 (Wed) |

Supermax Corporation Bhd |

The Company has posted stellar performance in FY2020 due to the phenomenal demand for gloves due to the pandemic. Demand for gloves is expected to remain strong for the next 1 to 2 years before moderating. The Company has increased its production capacity to meet the incessant demand, but the question remains, what will be the Company do with the excess capacity once demand wanes? |

|

03.12.20 (Thur) |

Ageson Bhd (AGM) |

Ageson recorded a higher PBT margin of 43.6% in FY2020 (FY2019: 4.5%) thanks to a change in its business strategy to enhance the product value to customer. The improved profit margin has translated into a 647% in PBT to RM41.1 million in FY2020 as compared to RM5.5 million in FY2019. |

|

03.12.20 (Thur) |

GD Express Carrier Bhd (AGM) |

Except for the marked decline in the third quarter (January to March), the Group turnover increased by 16% to RM364 million (2019: RM313.9 million). However, increased operating costs and a change in accounting treatment caused group pre-tax profits to decline marginally to RM23.7 million (2019: RM32.4 million). GDEX expects competition to remain intense due to the influx of new players with pricing strategy and operating in a more agile model leveraging on technology. In view of the stiff competition, can it continues to stay ahead of its competitors? It is also proposing to change its Company’s Name from “GD Express Carrier Bhd” to “GDEX Berhad” |

|

03.12.20 (Thur) |

Technodex Bhd (AGM) |

The Group continued to be loss-making with a pre-tax loss of RM10.2 million (FPE2019: adjusted LBT of RM10.7 million). The Group has taken various initiatives to improve its financial performance such as tendering for more IT contracts, expand the offering of its IT solutions and services within the South-East Asia Region, and expansion of existing range of IT solutions and services. The effect of these measures on its financial performance remains to be seen. |

|

03.12.20 (Thur) |

GD Express Carrier Bhd (EGM) |

The Groups is seeking shareholders' approval for the proposed issuance of free Warrants C on the basis of one (1) Warrant C for every eight (8) existing GDEX Shares held on the entitlement date. |

|

One of the points of interest to be raised: |

|

|

Company |

Points/Issues to Be Raised |

|

Bonia Corporation Bhd |

The impairment on trade receivables increased sharply to RM8 million in FYE 2020 compared to RM1.6 million in FYE 2019?

|

|

Priceworth International Bhd (AGM) |

The Company made an impairment of RM4.5 million for its trade receivables for FYE 2020 compared to RM2.8 million in FYE 2019. (Page 86 of AR 2020)

|

|

Permaju Industries Bhd (AGM) |

Mr. Tang Boon Koon, the Executive Director of Permaju (“Mr. Tang”) was appointed to the Board on 5 June 2020. He is also the Executive Director of mTouche Technology Berhad, Meridian Berhad and Pasukhas Group Berhad. As the Executive Director of the Company, Mr. Tang is expected to devote his full-time commitment to Permaju as he is drawing salary, bonus and other benefits under the contract of service with the Company.

|

|

YTL Power International Bhd (AGM) |

In FY20, YTL Power’s overseas operations accounted for approximately 89.6% of the Group’s revenue (FY19: 85.6%). Meanwhile, the revenue contribution of Malaysian operation was lower at 10.4% (FY19: 14.4%).

Coupled with the declining financial contribution of Malaysian operation to YTL Power, how significant will the Malaysian operation be to the Group moving forwards?

|

|

YTL Corporation Bhd (AGM) |

The Company’s Cement Manufacturing & Trading segment suffered a pre-tax loss of RM2.4 million in FYE 2020 compared to a pre-tax profit of RM145.4 million in FYE 2019. (Page 13 of AR 2020)

|

|

Redtone International Bhd (AGM) |

Group revenue declined from RM211.4 million for financial period ended 30 June 2019 to RM177.9 million in FY2020. (Page 56 of AR). Trade receivables increased sharply from RM29.9 million as at 30 June 2019 to RM52.0 million as at 30 June 2020. (Page 112 of AR). What were the reasons for the sharp increase in trade receivables although revenue has declined significantly? Is there a need to review the Group’s credit risk management policy? |

|

Supermax Corporation Bhd (AGM) |

The Covid-19 pandemic has resulted in strong surge in the demand for gloves. The Company has benefited from strong sales and demand for gloves does not seem to be waning as the pandemic continues to spread globally.

|

|

Ageson Bhd (AGM) |

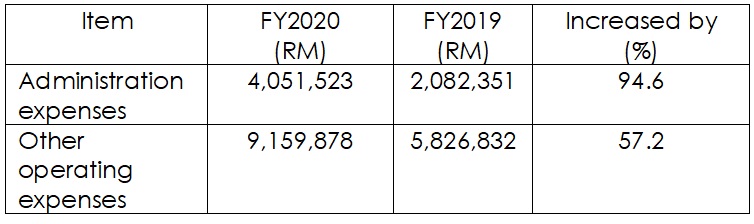

Expenses (Group level)

(Page 46 of the Annual Report 2020) What are the reasons for the significant increase in Administrative and Other operating expenses in FY2020? Does the Group expect these expenses to increase further in FY2021? If so, what is the estimated increase? |

|

GD Express Carrier Bhd |

Demand for express delivery services is expected to remain strong, and competition will intensify for market share (page 7 of Annual Report 2020 (“AR2020”).

|

|

Technodex Bhd |

The Group continued to be loss-making and recorded a loss before tax (“LBT”) of RM10.2 million (FPE2019: LBT of RM10.7 million) (page 7 of Annual Report 2020 (“AR2020”)). Mr. Peh Lian Hwa was appointed to the Board on 26 October 2020 as Non-Independent Non-Executive Deputy Chairman and he is also a major shareholder of the Company (page 13 of AR2020). With the emergence of a new major shareholder, are there new strategies to turnaround the business? What is the plan to bring the Group back to profitability? |

MSWG TEAM

Devanesan Evanson, Chief Executive Officer, ([email protected])

Linnert Hoo, Head, Research & Development, ([email protected])

Norhisam Sidek, Manager, Corporate Monitoring, ([email protected])

Lee Chee Meng, Manager, Corporate Monitoring, ([email protected])

Elaine Choo Yi Ling, Manager, Corporate Monitoring, ([email protected])

Lim Cian Yai, Manager, Corporate Monitoring, ([email protected])

Ranjit Singh, Manager, Corporate Monitoring, ([email protected])

Nor Khalidah Mohd Khalil, Executive, Corporate Monitoring, ([email protected])

DISCLOSURE OF INTERESTS

•With regard to the companies mentioned, MSWG holds a minimum number of shares in all these companies covered in this newsletter.

DISCLAIMER

This newsletter and the contents thereof and all rights relating thereto including all copyright is owned by the Badan Pengawas Pemegang Saham Minoriti Berhad, also known as the Minority Shareholders Watch Group (MSWG).

The contents and the opinions expressed in this newsletter are based on information in the public domain and are intended to provide the user with general information and for reference only. Best efforts have been made to ensure that the information contained in this newsletter is accurate and current as at the date of publication. However, MSWG makes no express or implied warranty as to the accuracy or completeness of any such information and opinions contained in this newsletter. No information in this newsletter is intended to be or should be construed as a recommendation to buy or sell or an invitation to subscribe for any, of the subject securities, related investments or other financial instruments thereof.

MSWG must be acknowledged for any part of this newsletter which is reproduced.

MSWG bears no responsibility or liability for any reliance on any information or comments appearing herein or for reproduction of the same by third parties. All readers or investors are advised to obtain legal or other professional advice before taking any action based on this newsletter.