23.04.2021

The Minority Shareholders Watch Group is now on Twitter. The presence at Twitter is the first step for us to create strong social media presence and engage with our stakeholders more effectively. Do follow MSWG’s Twitter account at @MSWGMalaysia and share your thought on our tweets from time to time.ing

When UMA fails to deter the rise of Dataprep

A truly rags-to-riches story, share price of Dataprep Holdings Bhd, an information communications technology (ICT) service provider had soared over 772% from a low of 16.5 sen on the eve of Chinese New Year (11 February) to close at RM1.44 on 1 March within a fortnight.

The sharp rise in price and volume has prompted the stock exchange to issue an Unusual Market Activity (UMA) query to the Company on 1 March.

Claiming that it is unaware of circumstances leading to the meteoric rise of its share price, Dataprep said the group has been continuously working on new opportunities to enhance the value of the company.

“The board of directors will make the necessary announcement and comply with Bursa Securities Listing Requirements, in particular Paragraph 9.03 of the Main Market Listing Requirements on immediate disclosure obligations,” added the response to Bursa’s UMA.

Typically, an UMA query seeks to flush out the reasons behind a material rise in price and/or volume of a stock. And if the answer to the query is that the company is unaware of reasons for the share price and/or volume increase, the share price will tend to take a downtrend. However, this was not the case with Dataprep’s share price. Not only did the UMA query fail to quell interest in the stock, the stock resumed its meteoric rise.

On 10 March, the Exchange issued an advice to investors, urging them to exercise caution in the trading of Dataprep shares.

“The exchange will not hesitate to take appropriate regulatory action to ensure fair and orderly trading of Dataprep shares,” the Exchange pointed out in a statement.

The counter closed at RM3.15, after touching an intraday/all-time high of RM3.33 on the day the trading advice was issued.

Like the UMA query, the advice failed to stop the hike in the share price. The share price of Dataprep soared to an all-time high of RM4.13 on 16 March – a staggering increase of 2,400% from the 16.5 sen at the outset of the mind-boggling rally.

Recently, the stock proved that it still had much firepower left by resuming its meteoric run after dipping to a low of 72.5 sen on 13 April. For the one-week period between 14 and 21 April, the stock had climbed 255% to RM2.57.

No solid ground

For the record, Dataprep is known to be loss-making for several years. Its net loss widened to RM9.78 million in FY2020, compared to RM5.87 million a year ago despite a higher revenue of RM36.22 million (FY2019: RM28.92 million).

Minority shareholders should determine whether its recently-announced corporate developments are impressive enough to warrant the meteoric share price increases.

On 18 March, Bursa Malaysia issued a query letter with ten questions to Dataprep to seek further information. This was in relation to its earlier announced memorandum of collaboration (MOC) with Asia Coding Centre Sdn Bhd to form a strategic partnership to undertake a project in relation to providing integrated solution technology for COVID-19 screening for the Health Ministry (MOH).

In its query, Bursa Malaysia asked Dataprep to furnish further information pertaining to the collaboration as there was a lack of pertinent information to enable informed investment decision-making by shareholders.

Aside from revealing that the MOC would be effective for three years from 12 March onwards, the Company did not elaborate further on other salient information such as prospects of the project, estimated capital and investment outlay, potential project value, et cetera.

In addition, a proposed acquisition was announced on 15 March that would enable Dataprep to acquire 51% of the total issued and paid-up share capital of Asia Biomed Sdn Bhd for RM510 cash.

By all accounts, the MOC and proposed acquisition do not look compelling enough to warrant the steep rise in Dataprep’s share price.

No smoke without fire

Companies that furnish the standard line that “the board is not aware of any reasons that may have caused the unusual price and/or trading activity” amidst soaring share prices will draw the vigilance of regulators as the share price movements tend towards a not-so-fair and not-so-orderly market in the trading of those securities.

The market regulator has stated that “where the reply to the UMA query is found to be inaccurate or misleading subsequently, enforcement action may be taken against the listed issuer and the culpable directors for breach of the Main/ACE Market/LEAP Market Listing Requirements”.

Dataprep’s share-price resilience has proven that it is not necessarily true that the share price of a company will retreat immediately after being issued an UMA query or when the company replies that they are not aware of any reasons that may have contributed to the material share-price increases. On the contrary, the share-price of a handful of them surge upwards instead of retreating – this is utterly puzzling.

If you are a fundamental investor, and you see share prices surging upwards meteorically without reason, you should remember the words of renowned fund manager and author Peter Lynch who once said ‘Behind every stock, there is a company. Find out what it’s doing’.

The stock market is not meant to be a casino though some minority shareholders treat it as a casino; just make sure you are not the casino operator – directly or indirectly.

Devanesan Evanson

Chief Executive Officer

MSWG AGM/EGM Weekly Watch 26 – 30April 2021

For this week, the following are the AGMs/EGMs of companies which are in the Minority Shareholders Watch Group’s (MSWG) watch list.

The summary of points of interest is highlighted here, while the details of the questions to the companies can be obtained via MSWG’s website at www.mswg.org.my.

|

Date & Time |

Company |

Quick-take |

|

27.04.21 (Tue) 10.30 am |

Lotte Chemical Titan Holdings Bhd (AGM) |

In FY2020, Group revenue decreased by 18% (or RM1,537 million) from RM8,438 million to RM6,901 million due to the reduction in average product selling prices and sales volume. Despite its major statutory turnaround and the headwinds facing the petrochemical industry in FY2020, the Group’s operating profit has increased by 5% to RM272 million, from RM260 million in 2019 due to improved Polymer to Naphtha margin. However, profit after tax was lower at RM154 million from RM443 million recorded in FY2019, primarily due to higher share of losses from its U.S. associate’s operations. |

|

27.04.21 (Tue) 02.00 pm |

Westports Holdings Bhd |

Westports’ revenue surged by 11% y-o-y to RM1.97 billion in FY2020 mainly due to revenue from construction activities and higher container revenue which was driven by tariff increase and growth in value added services. Meanwhile, its PAT improved by 11% y-o-y to RM654 million in FY2020 mainly due to higher container revenue and reduction in fuel cost. It expects a low single-digit container throughput growth for 2021. The vaccination programs across the globe should pave the way for some gradual recovery in the regional and global economies. |

|

28.04.21 (Wed) 10.00 am |

Nestle (Malaysia) Bhd |

Nestle’s revenue decreased by 1.9% y-o-y to RM5.4 billion in FY2020. Export sales up by 1.6%, contributed RM1.1 billion of revenue, but this was negated by weak domestic revenue, which dropped 2.8% to RM4.3 billion in FY2020. Meanwhile, PAT declined by 17.9% y-o-y to RM552.7 million in FY2020, mainly due to significant Covid-19 related expenses.

Nestle foresees economic volatility to persist through 1H2021, it will continue to focus on safety of its people, supply of products to its customers and support vulnerable communities through different programs. |

|

28.04.21 (Wed) 10.00 am |

Malakoff Corporation Bhd (AGM) |

As a move towards the low carbon economy, Malakoff strives to continue expanding its renewable energy and the waste management portfolios. In FY2020, it has sealed three solar projects, secured two PPAs for its two small hydro projects and has successfully bid for a second biogas power plant in Johor. |

|

28.04.21 (Wed) 10.00 am |

Petronas Dagangan Bhd |

PetDag recorded RM18.7 billion of revenue in FY2020, a y-o-y decrease of 38.2% due to the decline in total sales volume and average selling price. Its net profit was lower at RM272.4 million in FY2020 as compared to RM829.5 million a year earlier as it was affected by the sharp decline in petroleum product prices at the beginning of year 2020 and the ensuing Covid-19-related movement restrictions. |

|

28.04.21 (Wed) 11.00 am |

Kumpulan H&L High-Tech Bhd (AGM) |

Kumpulan H&L High-Tech achieved revenue of RM18.5 million in FY2020, a decline of 18.2% compared to FY2019. It recorded a lower net profit of RM2.43 million, which was a 27.6% decline as compared to FY2019. This was due to reduction in turnover in the manufacturing segment despite an increase in plantation segment revenue.

It expects the recovery of its manufacturing business to accelerate starting from 2H2021 when its main markets in the USA and Europe and its population receive the vaccinations completely. |

|

28.04.21 (Wed) 11.00 am |

Country View Bhd |

For the FYE 30 November 2020 (“FY2020”), Country View recorded a revenue and PBT of RM90.2 million and RM19.6 million respectively as compared to the revenue and profit before tax of RM162.7 million and RM33.9 million in the previous year. |

|

28.04.21 (Wed) 05.00 pm |

Bintulu Port Holdings Bhd (AGM) |

The Group recorded operating revenue of RM707.31 million in FY2020, 1.27% lower than the RM716.42 million recorded in FY2019. PBT decreased by 27.8% to RM93.3 million (2019: RM129.3 million) mainly due to higher depreciation of right-of-use assets and provisions for maintenance dredging costs. Bintulu Port expects its performance in FY2021 will continue to be affected by the unprecedented impact caused by the ongoing Covid-19 pandemic. |

|

29.04.21 (Thur) 11.00 am |

Poh Huat Resources Holdings Bhd (AGM) |

Poh Huat’s sales to US and Canada accounted for 96% of the Company’s revenue for FY2020. The Company has to take steps to diversify its sales base to avoid over-dependence on its key markets. The Company is also flushed with cash with the cash balance at RM190 million for FY2020. Its deployment of its healthy cash balance which could have a telling effect on the performance of the Company in FY 2021. Besides, it should seriously consider returning the excess cash to shareholders in the form of special dividends. |

|

30.04.21 (Fri) 11.00 am |

Dynaciate Group Bhd (AGM) |

Dynaciate reported revenue of RM59.25 million for FYE 2020 compared to RM108.30 million for FPE 2019 due to lower productivity from work-in-progress as construction activities were halted during the MCO. It recorded a loss before tax (“LBT”) of RM18.16 million (FPE 2019: LBT of RM17.08 million) mainly due to lower revenue recognised which was insufficient to absorb the high fixed overheads and cost overruns as well as loss of RM2.67 million arising from the disposal of associates. |

|

30.04.21 (Fri) 11.00 am |

Ajiya Bhd (AGM) |

Ajiya’s revenue in FY2020 was 21.5% lower to RM255.0 million, mainly due to lower demand for the Group’s products. The profit net of tax in FY2020 registered at RM0.40 million compared to RM4.28 million in the preceding financial year, marking a reduction of RM3.88 million or 90.7% y-o-y. A one-off transaction in relation to the provision of bad debts has impacted the profitability of the Group. |

|

One of the points of interest to be raised: |

|

|

Company |

Points/Issues to Be Raised |

|

Lotte Chemical Titan Holdings Bhd (AGM) |

Despite a major statutory turnaround and headwinds facing the petrochemical industry in FY2020, LCT’s operating profit has increased by 5% to RM272 million, from RM260 million in 2019 due to improved Polymer to Naphtha margin. Nevertheless, PAT was lower at RM154 million from RM443 million recorded in FY2019, primarily due to higher share of losses from its U.S. associate’s operations (page 36 of IAR).

What were the main reasons for the share of losses from its U.S. associate’s operations? What are the catalysts to enable a turnaround performance of LCUC? |

|

Westports Holdings Bhd |

The Group’s accumulated impairment loss on trade receivables have increased significantly to RM8.1 million in FY2020 (FY2019: RM1.9 million) (Note 18, page 71 of AR 2020).

|

|

Nestle (Malaysia) Bhd |

|

|

Malakoff Corporation Bhd (AGM) |

Malakoff has identified the renewable energy (RE) and waste management & environmental services as the two key growth areas. In FY2020, Malakoff had sealed three sale and purchase agreements (SPAs) for three rooftop solar projects, two renewable energy power purchase agreements (REPPAs) with Tenaga Nasional Berhad for the two small hydro projects and has successfully bid for a second biogas power plant in Johor.

By then, will the RE and waste management businesses be sufficient to offset the loss of income from the expiration of the two PPAs? |

|

Petronas Dagangan Bhd |

What were the reasons for the significant increase in PPE expensed off?

|

|

Kumpulan H&L High-Tech Bhd (AGM) |

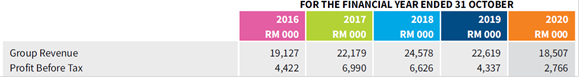

5 years’ financial highlights of the Group have shown a declining revenue and profit trend since FY2017 (page 4 of Annual Report (AR) 2020).

(Source: Page 4 of AR 2020) How does the Board plan to address the Group’s deteriorating financial performance, going forward? |

|

Country View Bhd |

The Group recorded a fair value gain of RM12.6 million from the transfer of property inventories to investment properties in FY2020 and RM10.3 million in FY2019. (page 89 of AR).

Why did the Group dispose investment properties at a loss of RM23,000 in FY2020 as compared to RM1.1 million gain reported in FY2019? |

|

Bintulu Port Holdings Bhd (AGM) |

In FY2020, the Group’s cargo throughput has declined 5.05% to 47.61 million tonnes and container throughput also dipped 1.7% to 339,660 TEUs compared to previous year. (Page 24 of Integrated Annual Report (IAR) 2020) In view of the on-going Covid-19 pandemic which is affecting the global supply chain in the port services industry, what is the outlook on cargo and container throughput growth for Bintulu Port and Samalaju Port in 2021? |

|

Poh Huat Resources Holdings Bhd (AGM) |

96% of the sales of the Company for FYE 2020 were derived from US and Canada. (Page 6 of AR 2020) These markets were severely affected by the pandemic.

How does the Company ensure that the raw materials that it sources i.e. timber comes from sustainable forests as its key export markets of US and Canada have very strict requirements that the furniture they import has to come from sustainable forests? |

|

Dynaciate Group Bhd (AGM) |

The amount paid for non-audit services, including the recurring and non-recurring non-audit services provided by the external auditor and its local affiliates amounted to RM69,000 and this was 61.06% of the audit fees of RM113,000 in FYE2020 (Page 41 of the Annual Report 2020).

What is the Company’s policy in relation to non-audit fees and audit fees? Is there a limit as to the percentage of non-audit fees to audit fees (or total fees) paid to the external auditor and its affiliates? |

|

Ajiya Bhd (AGM) |

The Group has plans to diversify its business portfolio in order to widen its revenue base and to attain better operating margins. It has identified several prospective businesses that would complement its existing business and help to expand its value chain. Among these options is the plan to position Ajiya as a main contractor in undertaking IBS construction projects nationwide (Page 28 of the Annual Report 2020).

What is the Group’s targeted revenue percentage and operating profit margin contribution to be derived from the business? |

MSWG TEAM

Devanesan Evanson, Chief Executive Officer, ([email protected])

Linnert Hoo, Head, Research & Development, ([email protected])

Norhisam Sidek, Manager, Corporate Monitoring, ([email protected])

Lee Chee Meng, Manager, Corporate Monitoring, ([email protected])

Elaine Choo Yi Ling, Manager, Corporate Monitoring, ([email protected])

Lim Cian Yai, Manager, Corporate Monitoring, ([email protected])

Ranjit Singh, Manager, Corporate Monitoring, ([email protected])

Rita Foo, Manager, Corporate Monitoring, ([email protected])

Nor Khalidah Mohd Khalil, Executive, Corporate Monitoring, ([email protected])

DISCLOSURE OF INTERESTS

•With regard to the companies mentioned, MSWG holds a minimum number of shares in all these companies covered in this newsletter.

DISCLAIMER

This newsletter and the contents thereof and all rights relating thereto including all copyright is owned by the Badan Pengawas Pemegang Saham Minoriti Berhad, also known as the Minority Shareholders Watch Group (MSWG).

The contents and the opinions expressed in this newsletter are based on information in the public domain and are intended to provide the user with general information and for reference only. Best efforts have been made to ensure that the information contained in this newsletter is accurate and current as at the date of publication. However, MSWG makes no express or implied warranty as to the accuracy or completeness of any such information and opinions contained in this newsletter. No information in this newsletter is intended to be or should be construed as a recommendation to buy or sell or an invitation to subscribe for any, of the subject securities, related investments or other financial instruments thereof.

MSWG must be acknowledged for any part of this newsletter which is reproduced.

MSWG bears no responsibility or liability for any reliance on any information or comments appearing herein or for reproduction of the same by third parties. All readers or investors are advised to obtain legal or other professional advice before taking any action based on this newsletter.