06.11.2020

Time not on FGV side due to uncertainties

The adage “time and tide wait for no man” is most relevant in today’s corporate world that is besieged by a health crisis of gargantuan scale.

FGV Holdings Bhd quickly comes to mind when delving on time as a precious commodity. Perhaps due to the nature of its business dealings, certain affairs cannot be expedited. They simply have to toe the line no matter how much time is required to complete such tasks.

Welcome to the Federal Land Development Authority (FELDA)-inspired Land Lease Agreement (LLA) termination saga which has recently joined the endless list of disruptive developments that is hindering a healthy turnaround for FGV Holdings Bhd.

But first, let’s set the record straight. On 1 November 2011, FGV entered the LLA with FELDA to lease around 350,733 hectares of estates from the latter for 99 years. The LLA commenced on 1 January 2012 which was ahead of FGV’s Bursa Malaysia listing in mid-2012.

According to FGV’s initial public offering (IPO) prospectus dated 31 May 2012, FELDA is permitted to terminate the tenancy lease, in parts or whole, for any reason after giving appropriate notice and paying the requisite compensation.

As of 28 August 2020, FELDA held a 21.24% stake in FGV, Felda Asset Holdings Company (12.42%) and Koperasi Permodalan Felda Malaysia Berhad (4.75%). Also, key to note is that the Ministry of Finance Inc holds a special share in FGV.

Times consuming process

Fast forward to current times, the brouhaha surrounding this highly ‘politicised’ development has given the impression that the future of FGV is filled with countless possibilities insofar as the investing public is concerned.

FELDA finds itself in a catch-22 situation given its approximately 33% stake in FGV. Any decision made by FELDA to the detriment of FGV will come back to haunt FELDA by virtue of its stake in FGV. This must have been considered carefully before making any decision regarding the LLA.

First and foremost, FGV has yet to receive a written notice from FELDA regarding the termination.

This has prompted FGV’s chairman Azhar Abdul Hamid to write to his FELDA counterpart Datuk Seri Idris Jusoh that the official termination notice from FELDA for the LLA was still not forthcoming.

Azhar has also suggested to stop any further issuances of media releases on the matter and to have a discussion before releasing a joint statement on the agreed terms in accordance with the terms and conditions of the LLA (Source: FGV’s announcement dated 2 November 2020)

A joint statement is preferable although FELDA is not obliged to, as FELDA is not a listed company and owes no continuing listing obligations to make disclosures through Bursa Malaysia or even jointly with FGV.

Minority shareholders should take the public announcement on terminating the LLA as the decision of the cabinet (and FELDA) though it has not been formally communicated to FGV.

Even assuming FELDA has submitted an official notice as required under the LLA, FGV will require a timeline of 18 months to tabulate the compensation sum.

The expected compensation amount may range between RM3.5 billion and RM4.3 billion, based on its internal assessment of its financial performance in 2020 and 2021, and other various factors. As a perspective, FGV’s market capitalisation stood at RM3.87 billion as of 30 October.

As the clock continues to tick, both FELDA and FGV must agree with the final figure – otherwise expect more time to be spent on the negotiation table amid amicable search for the magical figure.

Already, there are statements made to indicate that the compensation may be lower than that estimated by FGV (Source: Article titled “Felda's compensation to be less than what FGV expects” dated 30 October 2020, published on The Star). As they say, there is many a slip between the cup and the lip.

Let us hope that the compensation issue does not result in litigation as this would be a further distraction to FGV.

18 months and counting

Now assuming that the magical figure to terminate the LLA has been identified, do expect another year or longer – for FGV to re-engineer its operations as a downstream palm oil player (from a major upstream plantation company to a midstream and downstream player).

The waiting period may nevertheless seem worthwhile on grounds that the anticipated RM3.5 billion - RM4.3 billion compensation could serve as a war chest for FGV to look for new landbank, repay its borrowings or pay additional dividends.

As of end-FY2019, FGV had gross external borrowings of RM4.0 billion with loans of RM1 billion due to FELDA.

It is highly likely that we will see FGV taking at least two years or longer for it to resolve the LLA saga and then re-emerge as a new entity in its entirety.

While this is the likely prospect, nothing is certain, given the expression of interest by Perspective Lane (M) Sdn Bhd – a wholly-owned unit by tycoon Tan Sri Syed Mokhtar Albukhary’s privately-owned Restu Jernih Sdn Bhd – to participate in FGV via an injection of plantation assets in the latter materialises.

For the record, FGV has on 15 October received an expression of interest from Perspective Lane to participate in FGV via asset injection in exchange for a reasonable stake in the latter.

On hindsight, the asset injection by Perspective Lane which in turn owns the Tradewinds group of companies, including Tradewinds Plantation Bhd (taken private on May 2013), will increase FGV’s landbank size to 212,170 hectares. If this happens, FGV will retain its position as the second biggest plantation company after Sime Darby Plantation Bhd.

“While details remain sketchy at this juncture, the latest development could trigger a mandatory general offer (MGO) as Perspective Lane has a book value of circa RM1.9 billion as of 31 December 2018 (vs FGV’s book value of circa RM4.2 billion as of 31 December 2019),” noted Hong Leong Investment Bank Research.

Legacy quagmire

While these forward-looking events linked to the LLA saga may sound positive, investors who have been keeping a watchful eye on FGV since its infancy days can be forgiven for not pinning high hopes for them to bear the desired fruit.

Minority investors – from FELDA settlers to retail investors – cannot be blamed for losing faith in the stock, having to witness an erosion of stock value to only a quarter of its IPO price in recent times.

Listed in mid-2012 amid much fanfare, FGV was hailed as the second largest IPO of the year globally after Facebook. Recall that the IPO of 2.2 billion FGV shares at RM4.55 apiece raised RM5.99 billion for FELDA while FGV itself gained RM4.89 billion from the listing exercise.

Traded as high as RM5.46 during its listing day, FGV is now a pale shadow of its former self with its share price being barely a quarter of its IPO price.

Even against a backdrop of soaring crude palm oil (CPO) price RM3,100/metric tonne (MT) in mid-September 2020 (from the year-to-date low of RM2,000/MT in May 2020), FGV has continued to find itself embroiled in controversial developments.

Incidences ranging from funds misappropriation to abuses such as corruption and criminal breach of trust are well-documented.

In April 2019, the White Paper on FELDA confirmed that the loss-making planter bought six companies above market price for a total sum of RM2.48 billion.

On 23 November 2018, FGV initiated legal action against 14 former directors and top management personnel to recover a RM514 million loss from its RM1.1 billion acquisition of London-listed Asian Plantation Ltd (APL) in 2014.

FGV named former chairman Tan Sri Mohd Isa Samad and former group president and chief executive officer Mohd Emir Bavani Abdullah, among others, in the lawsuit.

Similarly on 30 November 2018, FGV commenced legal proceedings at the Kuala Lumpur High Court against Isa Samad and Emir Bavani for RM7.69 million in relation to the purchase of two luxury condominium units at Troika, KLCC at prices significantly above market value and without proper due diligence.

Even if there is a political will to re-enact its glorious past by overhauling its entire business operations, the truth is that there are simply too many potential pitfalls that modern day management science is able to contend with.

There are some key points that the minority shareholders of FGV should take note of:

- Will FGV’s expected compensation amount ranging between RM3.5 billion and RM4.3 billion materialise or will it eventually be a lower amount?

- Will the compensation issue be protracted and drawn out taking more time and resulting in more uncertainties?

- Will the expression of interest from Perspective Lane to participate in FGV via an asset injection in exchange for a reasonable stake happen?

- How will the compensation be utilised?

- Are minority shareholders prepared to wait for at least two years or longer to see greater visibility in FGV?

Devanesan Evanson

Chief Executive Officer

MSWG AGM/EGM Weekly Watch 9 – 13 November 2020

For this week, the following are the AGMs/EGMs of companies which are in the Minority Shareholders Watch Group’s (MSWG) watch list.

The summary of points of interest is highlighted here, while the details of the questions to the companies can be obtained via MSWG’s website at www.mswg.org.my.

|

Date & Time |

Company |

Quick-take |

|

11.11.20 (Wed) |

Gadang Holdings Bhd |

Gadang recorded a y-o-y 2% decrease in revenue to RM673 million in FY20 (FY19: RM687.7 million), due to lower revenue billings for the Property Division’s sales. Its pre-tax profit reduced 17% y-o-y to RM59.3 million due to higher administrative expenses, fair value loss on quoted investment and lower rental income of plant and machinery.

It expects the outlook of construction and property industries to be challenging. Nevertheless, its utility division is expected to contribute stable and recurring income to the Group. |

|

12.11.20 (Thur) |

Sime Darby Bhd (AGM) |

Sime Darby’s revenue rose marginally to RM36.9 billion in FY20 (FY19: RM36.1 billion). Despite a 14% decline in its net profit to RM820 million (FY19: RM948 million), its core net profit was up 10% to approximately RM1 billion (FY19: RM940 million) due to the robust performance of its Australian operation under the Industrial Division, and the strong rebound of both Industrial and Motors operations in China. Amid the ongoing Covid-19 pandemic, FY21 is expected to be challenging for Sime Darby. However, with its free cash flow of RM1 billion, it is in a comfortable position to face future challenges. |

|

12.11.20 (Thur) |

Eksons Corporation Bhd |

Eksons has been in a loss-making position for the last 5 financial years. With the pandemic affecting the demand for its products, it has huge obstacles to overcome to return on the path of profitability. Its property business is also facing challenges with a high inventory level. The FY21 will be a critical year for Eksons as it will decide if it could absorb the effects of Covid-19. |

|

One of the points of interest to be raised: |

|

|

Company |

Points/Issues to Be Raised |

|

Gadang Holdings Bhd |

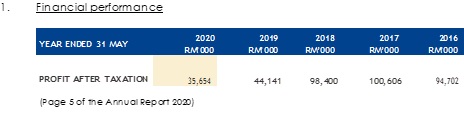

In FY2020, the Group recorded the lowest profit after tax since FY2017. In fact, in 2019, the profit dropped by more than 50% of 2018’s profit. How does the Board plan to address the Group’s deteriorating financial performance, moving forward? |

|

Sime Darby Bhd (AGM) |

There was a fatality involving a contracted stevedore at the Group’s Weifang Port in China, who died of heatstroke whilst unloading cargo (pages 24&25 of Annual Report 2020 (“AR2020”)). In FY2020, the three Jining ports suspended operations for 71 days due to a severe air pollution alert and inspection by port authorities. This significantly lowered cargo throughput for the year (page 83 of AR2020).

Given the two incident of climate change risks that posed a threat to humanity and business operations, what was the capital expenditure spent for environmental sustainability? What will be the estimated amount of capital expenditure to be incurred for environmental sustainability in 2021? |

|

Eksons Corporation Bhd |

Timber Division’s inventories were written down by RM11.7 million in FYE 2020 (FYE 2019: RM4.6 million) due to the weak demand and lethargic economic conditions. (Page 13 of AR 2020)

|

MSWG TEAM

Devanesan Evanson, Chief Executive Officer, ([email protected])

Linnert Hoo, Head, Research & Development, ([email protected])

Norhisam Sidek, Manager, Corporate Monitoring, ([email protected])

Lee Chee Meng, Manager, Corporate Monitoring, ([email protected])

Elaine Choo Yi Ling, Manager, Corporate Monitoring, ([email protected])

Lim Cian Yai, Manager, Corporate Monitoring, ([email protected])

Ranjit Singh, Manager, Corporate Monitoring, ([email protected])

Nor Khalidah Mohd Khalil, Executive, Corporate Monitoring, ([email protected])

DISCLOSURE OF INTERESTS

•With regard to the companies mentioned, MSWG holds a minimum number of shares in all these companies covered in this newsletter.

DISCLAIMER

This newsletter and the contents thereof and all rights relating thereto including all copyright is owned by the Badan Pengawas Pemegang Saham Minoriti Berhad, also known as the Minority Shareholders Watch Group (MSWG).

The contents and the opinions expressed in this newsletter are based on information in the public domain and are intended to provide the user with general information and for reference only. Best efforts have been made to ensure that the information contained in this newsletter is accurate and current as at the date of publication. However, MSWG makes no express or implied warranty as to the accuracy or completeness of any such information and opinions contained in this newsletter. No information in this newsletter is intended to be or should be construed as a recommendation to buy or sell or an invitation to subscribe for any, of the subject securities, related investments or other financial instruments thereof.

MSWG must be acknowledged for any part of this newsletter which is reproduced.

MSWG bears no responsibility or liability for any reliance on any information or comments appearing herein or for reproduction of the same by third parties. All readers or investors are advised to obtain legal or other professional advice before taking any action based on this newsletter.